Stock Market Volatility 2025

Stock market volatility in 2025 has taken investors on a wild ride during the first four months of the year. The seven days following Trump’s “Liberation Day” tariff announcement saw the S&P 500 drop more than 12%. Then, on April 9th, he backed off and announced a 90-day pause on reciprocal tariffs, leading the S&P to rebound by 9.5%. Updates continue to flow day after day. As of 5/13 the S&P 500 has erased all of its losses in 2025.

What History Teaches Us About Market Declines

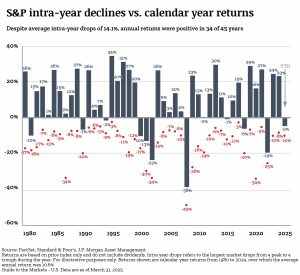

It’s common industry knowledge that if one can’t ride out an equity market decline of close to 15% every year (and a decline averaging twice that every one in five years) then they should not be an equity investor.

S&P intra-year declines vs. calendar year returns

At the same time, we know that equity investments are paramount to safeguarding your financial assets against inflation and ensuring you can continue the lifestyle you currently enjoy until your last days.

Financial Planning: Your Best Defense Against Uncertainty

Financial planning helps us find the balance between how much risk you need and how much risk you can stomach. At Kowalski Financial we consider the unique circumstances of our clients when investing their nest egg, often ensuring that retirees have the equivalent of several years of living expenses NOT exposed to the volatility of the stock market.

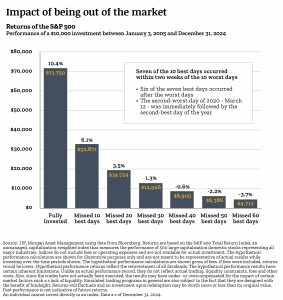

It’s important to remember that equity investing has a long-term time horizon. The idea is that you don’t want to pull money out of the stock market when it’s in a downward spiral. For this reason, we don’t recommend reacting to large market movements as they’re happening.

Impact of being out of the market

That being said, if the volatility of the first four months of this year caused you to lose sleep for fear that your equity investments would not recover, it might be worth considering an adjustment to your asset allocation for the long-term. However, keep in mind that for most Americans it’s impossible for your money to last your lifetime without having some allocation to stocks (remember inflation).

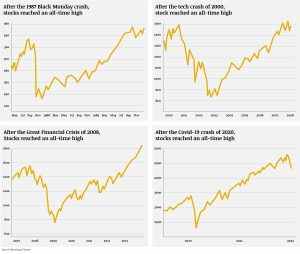

A Long-Term Perspective on Stock Market Recovery

The current administration in Washington has made clear that it’s here to shake things up and if there’s one thing that markets don’t like it’s change and uncertainty. As updates to tariff policies continue to roll in, investors and the public will continue to react. What’s certain is that no one knows exactly where markets will end this year. However, at this point we have no reason to think that equity markets will not recover as usual and go on to perform in the same manner they have for decades.

Returns after stock crashes

While stock market volatility in 2025 may feel unsettling, it’s important to remember that short-term swings are a normal part of long-term investing. Historically, the market has rebounded from similar events and gone on to reach new highs. Your financial plan is built to withstand periods like this—so stay focused on the long-term.

Conclusion: Invest for the Future, Not the Headlines

So remember that any money allocated to the stock market is there to help battle the purchasing power erosion of inflation. Your financial plan has likely resulted in several years of spending money NOT allocated to the stock market. And finally, we have no reason to believe that the stock market will not continue to behave as it has in the past, trending upward and to the right over the long term.

Olivia Stacey, CFA, CFP®