Will there be a recession in 2023?

I wanted to give you an update on markets and historical returns as well as give you some economic highlights. The 1 year trailing return is -5.78% and the 3 year trailing annualized return is +15.35%. Valuations for the S&P 500 remain high and we believe the chances of a recession have increased. Labor markets are the wildcard and I will touch on that shortly. We expect elevated volatility in the stock market for rest of 2023. While short term can be bumpy for investors, in particular the ones with higher stock market allocations.

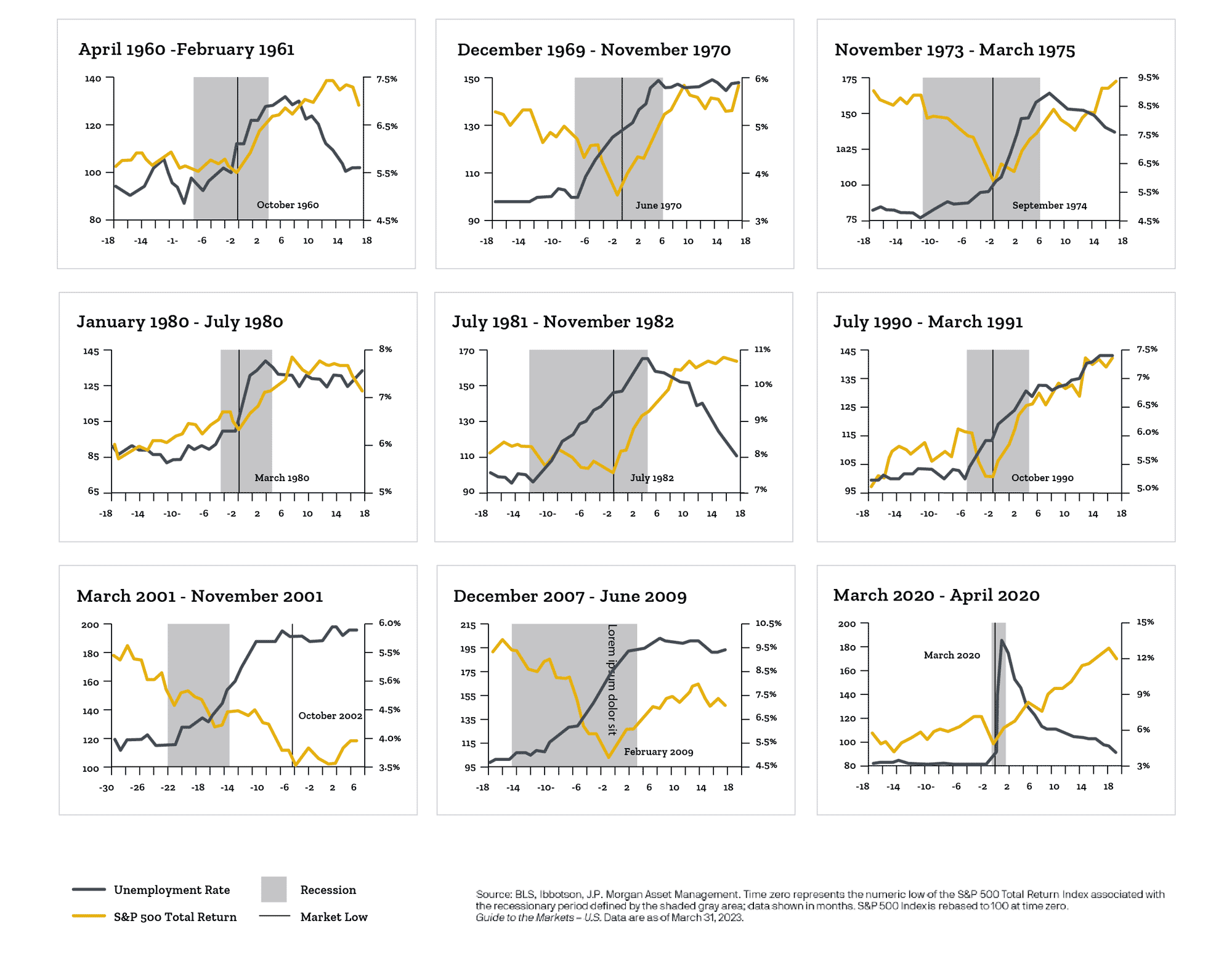

Market inflection points, recessions and the unemployment rate

As you can see in the charts from 1960-2020, the cyclical low point of unemployment preceded these recessions and often means the economy has peaked. Who knows if we are there with unemployment but there are signs to say that unemployment could start inching up as a result of many factors. One big factor is the Federal Reserve’s goal of taming inflation by raising short term interest rates. The Fed Funds rate is up from .25% a year ago to 4.75% currently. As companies restructure to adjust to higher interest rates, you should continue to see layoffs continue in the short term thus bringing up the unemployment rate and possibly giving the Fed reason to pause or even start lowering rates. We see another round or two of increases, but maybe by year end a pause with chance rates go lower.

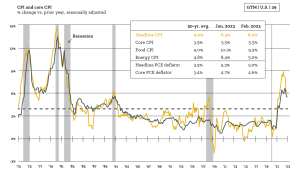

Inflation

50 years of US Inflation since 1973 As you can see in the chart above, inflation seems to have turned a corner. This could be a blip on it’s way higher but we are of the opinion inflation will come down closer to a 50 year average of 4% by 2024. Side note; The Federal Reserve’s inflation goal is 2%.

So will there be a recession in 2023? While we see green shoots for 2024, investors should keep their seat belts on for potentially higher than normal volatility the remainder of 2023.

Here at Kowalski Financial Services we factor downward volatility into our clients plan and we manage this by being opportunistic and focused on time horizons for income and cash needs. We ensure money you will need to spend over the next 12-24 months is not exposed to the volatility of the stock market.