Uncategorized

How to Budget for Your Dream Vacation—Without the Stress

Picture this: You and your partner are waking up to the sound of waves, sipping coffee on your balcony overlooking the Mediterranean. A cruise through Europe’s stunning coastlines is the goal—now, let’s talk about how to budget for your dream vacation to make it happen. Okay, maybe the idea of being stuck on a ship…

Read MoreStock Market Volatility 2025

Stock market volatility in 2025 has taken investors on a wild ride during the first four months of the year. The seven days following Trump’s “Liberation Day” tariff announcement saw the S&P 500 drop more than 12%. Then, on April 9th, he backed off and announced a 90-day pause on reciprocal tariffs, leading the S&P…

Read MoreWhat is the difference between a Roth IRA and a Traditional IRA?

A Roth IRA and a Traditional IRA both help you save for retirement, but there is a difference in how you pay taxes and when you can withdraw money. Here is a breakdown of the differences between a Roth IRA and a Traditional IRA: Tax Treatment Roth IRA: Contributions are made with after-tax dollars (meaning…

Read MoreSaving for later: what are the retirement income options?

How are you able to maintain financial security, even after retirement? And when you have created a good retirement plan, did you keep the ever changing financial landscape into account? A good retirement plan helps you to make informed decisions about the way you can spend your time after you stop working. In this blog…

Read MoreHere’s a not so serious get ready for retirement quiz

So, you’re getting ready to retire. What will you do with all those Freedom Chips? Freedom Chips™ are a way to think about your financial life. They are your very own assets that you build up over time and then claim at the right time to do whatever it is you want to do. So,…

Read MoreThe importance of education planning

Providing for your family is important. A financial plan helps families create a carefree future and education planning plays an important role in that. How do you start making an education plan? Is it better to start saving or investing? And what do you need to know when it comes to making sure you and…

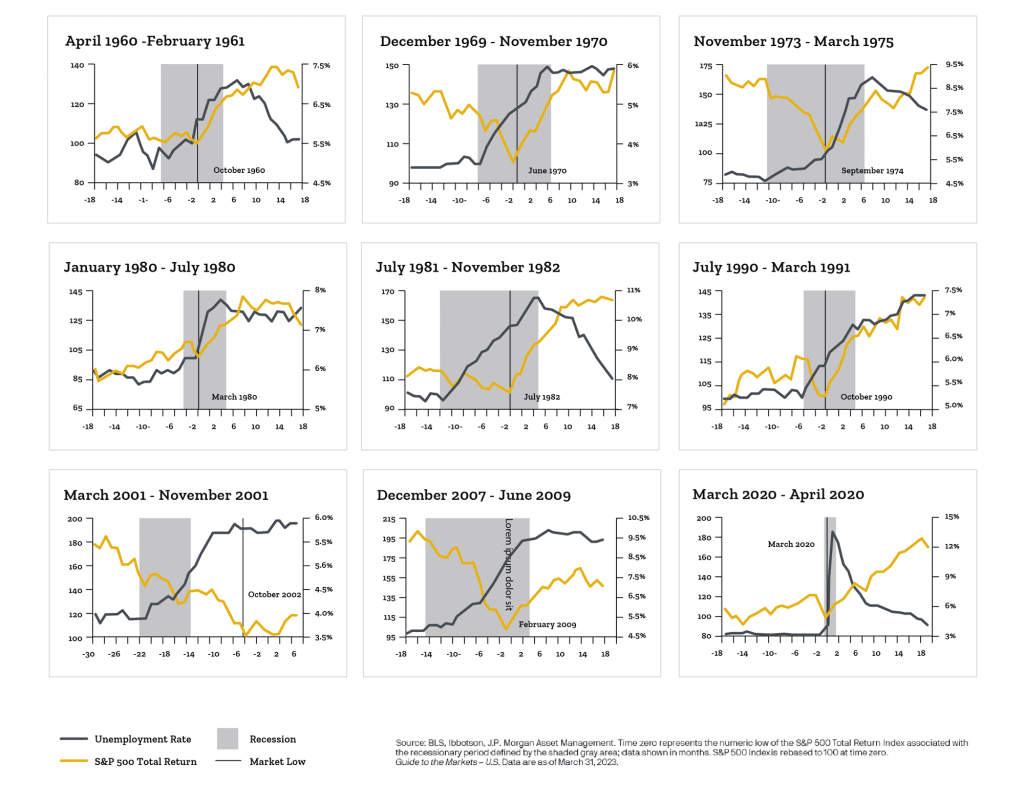

Read MoreWill there be a recession in 2023?

I wanted to give you an update on markets and historical returns as well as give you some economic highlights. The 1 year trailing return is -5.78% and the 3 year trailing annualized return is +15.35%. Valuations for the S&P 500 remain high and we believe the chances of a recession have increased. Labor markets…

Read More